Effective July 1, 2024, Washington D.C. has increased its minimum wage to $17.50 per hour for non-tipped employees and $10.00 per hour for tipped employees.

Key Takeaways for Workers

For workers, these changes promise increased earnings and greater financial stability:

- Tipped Employees: A 25% increase in the base wage for tipped employees ($8.00 to $10.00) will directly boost income, with additional protection against underpayment.

- Non-Tipped Employees: A steady rise in hourly wages ensures that workers keep pace with inflation.

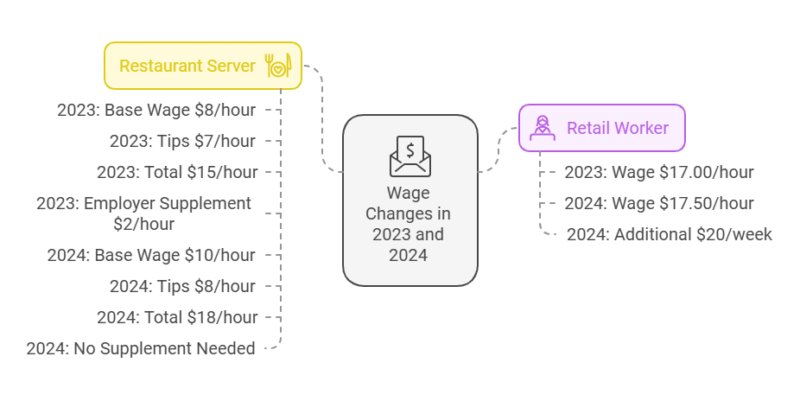

Real-World Scenarios

Scenario 1: A Restaurant Server

- 2023: Base wage = $8/hour; average tips = $7/hour. Total: $15/hour. Employer pays $2/hour difference to meet $17/hour.

- 2024: Base wage = $10/hour; average tips = $8/hour. Total: $18/hour. Employer no longer needs to supplement wages.

Scenario 2: A Retail Worker

- 2023: Hourly wage = $17.00/hour.

- 2024: Hourly wage = $17.50/hour, reflecting a $0.50/hour raise, providing an additional $20/week for a full-time employee.

Overview of Minimum Wage Changes

Effective July 1, 2024, Washington D.C. has implemented significant adjustments to its minimum wage structure, reflecting the city’s commitment to fair compensation and economic equity. The standard minimum wage for non-tipped employees has increased from $17.00 to $17.50 per hour, a change that applies uniformly across all employers, regardless of size according to Mayor of Washington, D.C.

For tipped employees, the base minimum wage has risen from $8.00 to $10.00 per hour. Employers are mandated to ensure that the total earnings of tipped employees, combining base wage and tips, meet or exceed the full minimum wage of $17.50 per hour. If an employee’s combined earnings fall short, the employer is required to compensate the difference.

These wage adjustments are part of an ongoing effort to align compensation with the cost of living, as measured by the Consumer Price Index (CPI).

In 2023, the CPI for the Washington Metropolitan Area increased by 2.8%, prompting the current wage increase as per the Bureau of Labor Statistics

These changes stem from the “Fair Shot Minimum Wage Amendment Act of 2016” and subsequent legislation, including the Tip Credit Elimination Act passed in 2022. The District of Columbia aims to progressively eliminate disparities between tipped and non-tipped wages by July 1, 2027.

A Comparison of Wages in 2023 and 2024

https://www.tiktok.com/discover/minimum-wage-2024-vs-1970

In 2024, Washington D.C. adjusted its minimum wage to align with the rising cost of living, as measured by the Consumer Price Index (CPI).

The CPI for the Washington-Arlington-Alexandria area increased by 2.8% in 2023, prompting a corresponding wage adjustment to maintain workers’ purchasing power.

Minimum Wage Adjustments: 2023 vs. 2024

Category

2023 Minimum Wage

2024 Minimum Wage

Increase

Non-Tipped Workers

$17.00 per hour

$17.50 per hour

+$0.50

Tipped Workers (Base)

$8.00 per hour

$10.00 per hour

+$2.00

Tipped Workers (Effective)

Must meet $17.00/hour

Must meet $17.50/hour

—

The base wage for non-tipped employees increased by $0.50, while tipped employees saw a $2.00 increase in their base wage.

Employers are required to ensure that the total earnings of tipped employees, combining base wage and tips, meet or exceed the full minimum wage of $17.50 per hour.

If an employee’s combined earnings fall short, the employer must compensate the differences as noted by the Department of Employment Services

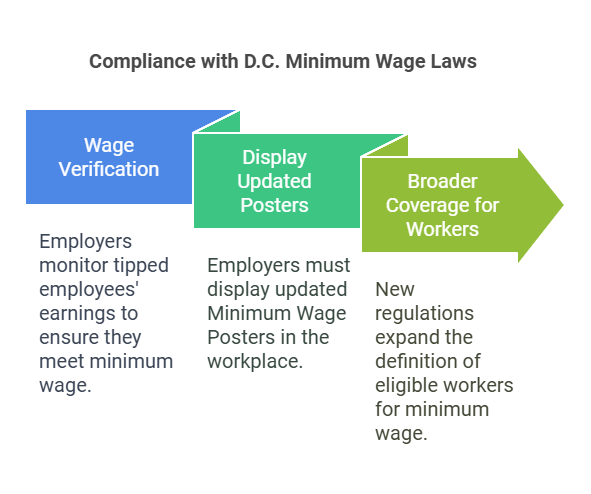

Implications for Employers

Employers in Washington D.C. are legally obligated to adhere to specific standards ensuring fair compensation for all workers, particularly tipped employees.

This involves rigorous tracking and verification processes:

- Wage Verification: Employers must carefully monitor the earnings of tipped employees. It is essential to confirm that the combined income from tips and the base wage meets or exceeds the full minimum wage of $17.50 per hour. If an employee’s earnings fall short, the employer is responsible for covering the gap, ensuring compliance with D.C. labor laws.

- Mandatory Display of Updated Posters: The Department of Employment Services (DOES) will issue updated Minimum Wage Posters, which employers must prominently display in the workplace. These posters inform employees of their rights under the updated minimum wage laws and serve as a compliance checkpoint during audits or inspections.

- Broader Coverage for Workers: New regulations expand the definition of employees entitled to the D.C. minimum wage. Now, any individual performing at least two hours of work in D.C. within a single workweek qualifies for the city’s minimum wage. This change ensures more workers are protected under the updated law, placing additional responsibilities on employers to identify and include eligible staff in their payroll adjustments.

- Planning for Future Increases: With tipped and non-tipped wages set to converge by 2027, employers must prepare for gradual wage increases over the next few years. Budgeting and payroll systems should be adjusted to accommodate these changes.

Broader Economic Context

Washington D.C. consistently leads the nation in minimum wage rates. Below is a comparison with neighboring states:

Region

Minimum Wage (2024)

Tipped Wage

Washington D.C.

$17.50

$10.00

Maryland

$15.00

$3.63

Virginia

$13.00

$2.13

Washington D.C. stands out in the region with the highest minimum wage at $17.50 per hour, significantly surpassing Maryland’s $15.00 and Virginia’s $13.00. This stark difference is reflective of D.C.’s recognition of its higher cost of living, which includes elevated housing, transportation, and general living expenses.

D.C. also leads in base wages for tipped workers at $10.00 per hour, compared to Maryland’s $3.63 and Virginia’s $2.13. This disparity highlights a key policy difference: while Maryland and Virginia still rely heavily on a tip credit system, D.C. is progressively eliminating it, aiming for complete parity between tipped and non-tipped wages by 2027. This approach ensures greater stability and equity for tipped employees, who may face inconsistent earnings.

The move to eliminate the tip credit aligns with national efforts to address wage disparities. By 2027, tipped workers in D.C. will receive the full minimum wage plus tips, a model that could inspire other jurisdictions.

Challenges and Opportunities

The rise in Washington D.C.’s minimum wage brings challenges and opportunities for small businesses. On one hand, higher labor costs can strain budgets, especially for restaurants and retailers. To manage this, businesses can invest in automation, like self-checkout kiosks, or adjust pricing, such as slightly increasing menu costs. Streamlining operations to boost efficiency can also help offset the impact.

On the flip side, higher wages mean workers have more disposable income, leading to increased spending at local businesses. This can drive growth and help businesses recover some of their added costs. Competitive wages also attract better talent and foster employee loyalty, which reduces turnover.

While the adjustment requires careful planning, businesses that innovate and adapt can find ways to thrive while supporting a more equitable economy.